Tell us what happened. Get started on usaa.com or the USAA Mobile App.

How homeowners claims work

We’ll help you with every step of your claim and provide personalized updates along the way.

Steps to complete How homeowners claims work

What you’ll need to file a claim

Give as much information as you can to help us process your claim, including:

- Photos of the damage.

- Receipts for any temporary repairs needed to prevent more damage.

- List of damaged items including brands and models.

- Proofs of purchase for damaged belongings, if available.

Should you file a homeowners claim?

You should always tell us about damage to your home. If you’re not sure what’s covered, you can check your policy.

It’s important to file a claim if:

- The cost of the damage to your property is more than your deductible.

- Living in your home is unsafe.

- You damaged someone else’s property.

- Someone else is responsible for the accident.

How homeowners deductibles work

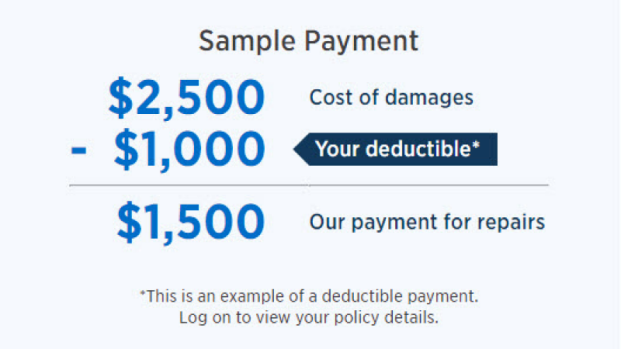

Your deductible is the out-of-pocket amount you'll pay for repairs or to replace items on a covered claim.

For example, if damages or stolen items cost $2,500 and your deductible is $1,000, then we would pay $1,500 for the repairs.

We'll automatically subtract your deductible from your claim payment. You're responsible for paying your deductible directly to the person or company that makes the repairs.

You can find your deductible on your homeowners policy.

More claims resources

Find answers to common questions about claims like what to do if the repairs are going to cost more than the estimate.

For more help, check out our claims videos.

Homeowners insurance claims FAQ

It depends on the circumstances and complexity of your claim. It can take longer if your damage was due to a natural disaster that also affected many others.

The length of your claim depends on several factors including:

- The amount of damage.

- The availability of contractors, especially if there's a waiting list after a natural disaster.

- Your availability.

Most insurance companies typically make two payments for a covered loss. The first payment is for the depreciated value of the covered damage at the time of your loss.

We sometimes make a second payment once you repair all the covered damages. This additional payment is often referred to as recoverable depreciation, or "holdback."

For example, if there's damage to your 10-year-old roof, the first payment may reflect the value of a roof that's 10 years old. Once you replace the roof, you may be reimbursed for the remaining cost of a new roof of similar kind and quality.

If you discover more damage after the work starts, let your adjuster know right away. You can message them through My Claims Center. They need to approve any additional costs before the contractor continues the repairs.

Your policy might cover the additional damage with a supplement, which is just another payment to you or your contractor. Keep in mind, your policy doesn’t cover the added cost of improvements or upgraded items.

Still need help?

If you can’t find the information you need, give us a call at 800-531-USAA (8722).