What you get with our auto policy

Whether you need basic quality coverage or more peace of mind, you can customize your car insurance. And you'll get service that can help when you need it most.

Telematics driving programs

We have two optional driving programs that may reward you for safe driving and low mileage.

Save with one of our driving programs.

When you get a car insurance quote, you'll have the option to enroll in one of these app-based programs.

-

USAA SafePilot®

Better driving means bigger discounts. Find out how you can improve your driving with SafePilot.

- Up to 10% at enrollment and up to 30% off your premiumSee note1 at renewal for driving safely

- Mobile driving app required for participating drivers

-

USAA SafePilot Miles™

Driving less? Save more.

- Up to 20% savings for lower mileage and an earned driving discount of up to 20% off your premiumSee note1 for driving safely

- Monthly rate adjusted based on mileage and other factors

- Mobile driving app required for each driver

Need commercial auto insurance?

Have fleet vehicles or a personal car you use for business? Coverage is available through the USAA Insurance Agency.

Other ways to make your car insurance cheaper

You don't have to sacrifice quality coverage and service to lower your premium. We can help with auto discounts and savings.

-

Bundle and Save

Save up to 10% when you bundle auto and property policies.See note2

-

Multi-Vehicle Discount

You'll save automatically when you have two or more vehicles on a policy.See note3

-

Good Student Discount

Get a discount on your car insurance if your student driver maintains good grades.See note3

-

Storage Discount

Save on your premium if you put your car in storage.See note4

-

Military On-Base Discount

Save up to 15% on your auto premium when you garage your car on base.See note5

Why choose USAA Auto Insurance

-

Members Save

A survey showed that our members saved an average of $725 per year when they switched to USAA Auto Insurance.See note6

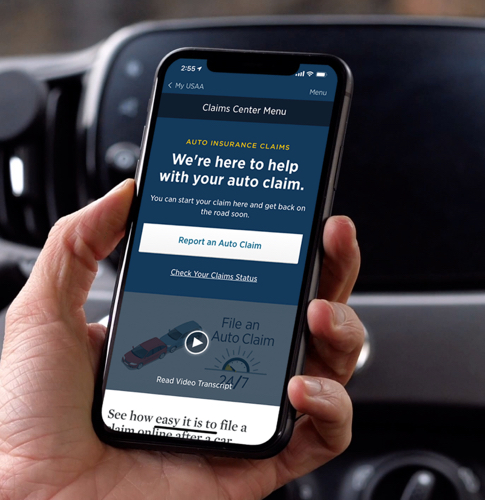

Manage your auto policy 24/7 with the USAA Mobile App.

- Get auto ID cards and proof of insurance.

- Add vehicles and drivers.

- Change your coverage.

- Pay your bill.

- Request roadside assistance.See note7

- File and manage claims.

How coverage can meet your needsSee note8

Looking for full coverage? You may be surprised that full coverage doesn't exist as an option when buying car insurance. If a bank or lender refers to it, they usually mean the minimum liability required by your state plus comprehensive and collision coverage for physical damage.

-

You damage your car in an accident.

If you back into a pole or collide with another vehicle while driving, get the help you need with collision coverage.

-

Something else damages your car.

Some things are out of your control. If your vehicle gets damaged from an incident like hitting an animal, fire or flooding, get help with comprehensive coverage.

-

Someone files a claim against you.

If you hit and injure another driver, you could be responsible for their medical bills and property damage. Help protect your assets with liability coverage.

-

A driver with no insurance hits you.

If a driver damages your car or injures you and can't cover the expenses, you may benefit from having uninsured and underinsured motorist coverage.

Need auto coverage overseas?

If you're going to PCS or you've decided to live abroad, overseas insurance could help you protect your car and property.

Who's eligible for USAA Auto Insurance?

- Active-duty military

- National Guard and Reservists

- Veterans who have honorably served

- Contracted ROTC cadets and midshipmen

- Officer and warrant officer candidates

- Spouses and children of USAA members

- Service academy appointees

How to get a car insurance quote

Getting a quote takes just a few minutes.

-

Tell us about the drivers.

You'll need their driver's license numbers.

-

Describe your vehicles.

Include the make, model, year and vehicle identification number (VIN) for each one.

-

Share your driving history.

Tell us about any accidents or tickets on your driving record.

-

Get your estimate.

Tailor your policy by adjusting coverage options.

Car insurance FAQ

There are many factors involved in determining auto insurance rates. How many miles you drive a year, your driving record and the coverage you choose play a part in how much you'll pay.

Car insurance resources

Find more tips and guidance in our library of auto insurance articles.

-

8 reasons auto insurance rates are rising

Article: 7 minutes

-

Protect yourself with proper insurance coverage.

Article: 7 minutes

-

How can a safe driving app save you money?

Article: 7 minutes

Save on stuff for your car with USAA Perks®.

Whether you're looking for discounts on products you want or services you need, make us your first stop.